🔹 Rethinking the Scale of Korea’s Content Industry

Many still underestimate the size and impact of Korea’s content industry. However, its economic scale rivals that of the semiconductor sector, long considered Korea’s backbone industry.

- According to data from Maeil Business Newspaper (2021), the sales revenue of the content industry in 2018 was KRW 126.7 trillion, closely approaching the semiconductor industry’s KRW 129.4 trillion.

- In terms of exports, the content sector is also competitive: In 2019, Korea’s content exports reached $10.19 billion, nearly equal to the 10th-ranked export item (plastic products, $10.29 billion).

📎 68 Trillion Won in Jobs and 126 Trillion in Sales: Korea’s Content Industry Rivaling Semiconductors

📎 Top 10 Export Products of Korea in 2019 – Yonhap News

Disclaimer: Due to the recent rise in semiconductor prices, the comparison with the content industry may vary depending on the current economic context.

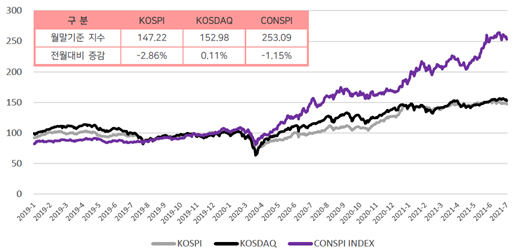

🔹 Content Industry Growth Outpacing KOSPI and KOSDAQ

Indicators like CONSPI (from Korea Culture & Tourism Institute) show that the content industry’s growth rate has outperformed Korea’s major stock indices like KOSPI and KOSDAQ, especially since the COVID-19 outbreak in February 2020.

🌍 External Factors Accelerating the Korean Content Industry

🔹 Post-China Strategy and Reduced Dependency

The Chinese ban on Korean content (Hallyu ban, aka 한한령) initially sparked concern, but in hindsight, it encouraged the industry to diversify away from China and expand into new global markets, leading to increased success.

📎 We Won’t Just Sit Back Under the Hallyu Ban

- Even before the ban, China’s heavy regulations on foreign content and its aggressive acquisition of Korean companies raised concerns over excessive dependency.

- Today, Korean content has successfully shifted toward broader global markets, reducing reliance on China.

🔹 OTT Wars and Weakening of China and Japan

The global OTT war—with Netflix, Disney+, HBO Max, Amazon Prime, iQIYI, etc.—has elevated demand for high-quality Korean dramas and content.

- Netflix was one of the first to invest aggressively in Korean originals.

- As OTTs compete to secure exclusive IP, Korean content became a strategic priority.

Meanwhile:

- Japan remains strong in animation but has seen a decline in live-action drama and entertainment competitiveness.

- China faces internal tension between its socialist governance model and market economy, resulting in growing inequality and systemic instability.

- Companies like TikTok and Zoom are globalizing, but conflicts with the Chinese government’s censorship and control are intensifying.

- This may lead to split platforms for domestic vs. global audiences, which could limit growth.

🔹 Rise of the Contactless Society

The shift to a contactless world, driven by the pandemic, has created new opportunities:

- Millennials, who consume global content via platforms like YouTube, have emerged as core cultural consumers.

- During COVID-19, Korea was one of the few countries where content production never fully stopped, giving it a unique advantage.

- Content sectors like gaming, webtoons, and streaming video saw significant increases in consumption.

- On the flip side, offline-based industries like cinema and concerts suffered.

Adaptation examples:

- Film industry: Shifted from theater-focused revenue to OTT distribution due to cinema closures.

- K-pop industry:

- Though concerts were halted, online concerts emerged as a revenue-saving model.

- In 2019, BigHit Entertainment earned KRW 587.2 billion; BTS alone accounted for around KRW 500 billion, with KRW 198.3 billion from touring concerts. (Source: Ebest Investment & Securities, 2020)